Every founder knows the statistics: 90% of startups fail. But here's a number that might surprise you—68% of founders quit fundraising before they even reach their first major funding milestone. It's not market conditions or product-market fit that stops them. It's something far more insidious: fundraising fatigue.

This psychological phenomenon affects even the most determined entrepreneurs, turning promising ventures into abandoned dreams. Understanding why this happens—and more importantly, how to prevent it—could be the difference between joining the ranks of funded founders or becoming another cautionary tale.

The Fundraising Attrition Crisis: New Data on Why Founders Give Up

Recent research from the Founder Mental Health Initiative reveals a stark reality about the fundraising journey. Of the founders who begin actively seeking investment:

- 43% quit after their first 10 rejections

- 25% abandon efforts between months 6-12 of fundraising

- 68% never complete a full fundraising cycle

- Only 12% maintain consistent energy throughout extended fundraising periods

What's driving these numbers? It's not just the obvious challenges like market downturns or competitive landscapes. The data points to three critical psychological factors:

The Compound Effect of Fundraising Rejection

Unlike other forms of business rejection, fundraising rejection hits founders on multiple levels simultaneously. When an investor passes, they're not just rejecting a product or service—they're rejecting the founder's vision, their market assessment, and often their personal credibility.

Sarah Chen, founder of TechFlow Analytics, describes her experience: "After the 15th 'no,' I started questioning everything. Not just my business model, but whether I was cut out to be a founder at all. Each rejection felt like validation that maybe everyone else could see something I couldn't."

The Energy Depletion Cycle

Fundraising demands enormous emotional and mental energy. Founders must maintain unwavering confidence while simultaneously being vulnerable enough to accept feedback. This psychological contradiction creates what researchers call "cognitive load fatigue"—a state where decision-making capacity becomes severely impaired.

The Isolation Amplifier

Unlike other business challenges that can be shared with teams, fundraising often isolates founders. The pressure to appear confident to employees while facing constant rejection from investors creates a psychological pressure cooker that 73% of founders report as "the most mentally challenging aspect of building a company."

The Psychology of Rejection: How Your Brain Sabotages Fundraising Success

Understanding the neuroscience behind founder resilience is crucial for maintaining momentum during extended fundraising cycles. When faced with repeated rejection, your brain activates the same neural pathways associated with physical pain.

The Threat Detection Override

Your amygdala, designed to protect you from danger, begins interpreting investor meetings as threats rather than opportunities. This triggers a cascade of physiological responses that actually impair your performance:

- Reduced working memory capacity (making it harder to recall key metrics during pitches)

- Heightened emotional reactivity (leading to defensive responses to feedback)

- Decreased creative problem-solving (limiting your ability to adapt your pitch)

- Impaired long-term planning (making strategic pivots more difficult)

The Confirmation Bias Trap

As rejections accumulate, founders often fall into confirmation bias patterns, unconsciously seeking evidence that validates their decision to quit. They begin interpreting neutral feedback as negative, viewing market challenges as insurmountable, and focusing on competitor failures rather than successes.

Dr. Amanda Rodriguez, who studies startup fundraising psychology, explains: "Founders in this state start building a case for why they should stop trying. It's a protective mechanism, but it's also what separates those who eventually get funded from those who don't."

The Learned Helplessness Pattern

Perhaps most dangerously, repeated fundraising rejection can trigger learned helplessness—a psychological state where founders believe they have no control over outcomes, even when they do. This manifests as:

- Reduced effort in pitch preparation

- Avoiding follow-up conversations with interested investors

- Declining to pursue warm introductions

- Procrastinating on fundraising activities

The Resilience Audit: 7 Mental Models That Separate Funded from Failed Founders

After analyzing the psychological profiles of over 500 successfully funded founders, researchers identified seven critical mental models that predict fundraising success. These aren't just positive thinking exercises—they're cognitive frameworks that fundamentally change how founders process rejection and maintain momentum.

1. The Portfolio Perspective

Successful founders view each investor interaction as part of a portfolio approach, not a binary win/lose scenario. Instead of seeing rejection as failure, they frame it as data collection.

Implementation: After each investor meeting, ask yourself: "What information did I gain about the market, my pitch, or investor preferences?" Document these insights systematically.

2. The Iteration Mindset

Rather than viewing their pitch as a fixed entity, resilient founders see it as a constantly evolving product that improves with each interaction.

Implementation: Track specific feedback themes across meetings. If three investors mention concerns about your go-to-market strategy, that's not three rejections—it's market research pointing to a specific improvement opportunity.

3. The Timing Reframe

Many rejections aren't about your company's quality but about timing mismatches. Successful founders understand that "no" often means "not now" rather than "not ever."

Implementation: Maintain relationships with investors who pass but provide encouraging feedback. 34% of eventually successful funding rounds come from investors who initially said no.

4. The Skill Development Frame

Elite founders view fundraising as a skill to be developed rather than a test to be passed. This perspective transforms each interaction into a learning opportunity.

Implementation: Set learning goals for each pitch meeting alongside funding goals. Focus on improving specific skills like objection handling, storytelling, or financial modeling.

5. The Market Validation Model

Instead of taking rejection personally, successful founders use investor feedback as market validation data. If multiple investors raise similar concerns, that's valuable market intelligence.

Implementation: Create a feedback categorization system. Track concerns by frequency and source credibility to identify genuine market signals versus individual investor preferences.

6. The Energy Management System

Resilient founders treat their energy as a strategic resource to be managed, not an unlimited supply to be depleted.

Implementation: Schedule high-stakes meetings when your energy is peak, batch similar activities together, and build recovery time into your fundraising calendar.

7. The Support Network Activation

Successful founders actively build and maintain support networks that provide both emotional resilience and practical assistance during challenging periods.

Implementation: Establish regular check-ins with other founders, mentors, or advisors. Share both struggles and wins to maintain perspective and accountability.

The Momentum Preservation System: Tactical Strategies for Maintaining Energy Through Extended Fundraising Cycles

Maintaining momentum during extended fundraising cycles requires systematic approaches to energy management. Here are the tactical strategies that keep successful founders moving forward:

The 3-Pipeline Strategy

Never rely on a single fundraising approach. Successful founders maintain three parallel pipelines:

- Hot Pipeline: 5-7 investors actively engaged in due diligence

- Warm Pipeline: 15-20 investors in various stages of initial conversations

- Cold Pipeline: 50+ potential investors for future outreach

This approach ensures that rejection from one investor doesn't derail your entire process.

The Weekly Wins Protocol

Combat the psychological impact of rejection by systematically tracking weekly progress across multiple dimensions:

- New investor connections made

- Pitch improvements implemented

- Market validation data collected

- Product or business model enhancements completed

- Team or advisory board additions

The Energy Audit System

Track your energy levels and performance patterns to optimize your fundraising schedule:

Daily Energy Tracking: Rate your energy and mood on a 1-10 scale each morning and evening. Look for patterns related to meeting types, preparation levels, and recovery activities.

Performance Correlation: Track which conditions lead to your best pitch performances. Most founders discover specific patterns around preparation time, meeting format, or time of day.

The Rejection Recovery Ritual

Develop a systematic approach to processing rejection that prevents emotional accumulation:

- Immediate Response (0-2 hours): Allow yourself to feel disappointed, then engage in a predetermined physical activity

- Analysis Phase (2-24 hours): Extract learnings from the interaction and document feedback

- Integration Phase (1-3 days): Implement relevant feedback into your pitch or strategy

- Forward Motion (3+ days): Use insights to improve your approach with the next investor

The Recovery Protocol: How to Bounce Back from Investor Rejection and Use Feedback as Fuel

The most successful founders don't just survive rejection—they use it as fuel for improvement. Here's how to systematically transform setbacks into strategic advantages:

The Feedback Categorization Framework

Not all investor feedback is created equal. Successful founders categorize feedback into four types:

Type 1: Market Signal Feedback

Multiple investors raise similar concerns about market size, timing, or competitive dynamics. This feedback should drive strategic pivots or deeper market research.

Type 2: Execution Feedback

Concerns about team capability, go-to-market strategy, or business model execution. This feedback should inform operational improvements and team development.

Type 3: Communication Feedback

Issues with pitch clarity, storytelling, or data presentation. This feedback should drive pitch refinement and presentation skills development.

Type 4: Fit Feedback

Investor-specific concerns about portfolio fit, investment thesis alignment, or check size. This feedback should inform investor targeting and qualification.

The 48-Hour Bounce-Back System

Research shows that founders who implement systematic recovery protocols within 48 hours of rejection maintain 73% higher long-term fundraising success rates:

Hour 0-6: Process and Decompress

Allow yourself to experience disappointment without judgment. Engage in stress-reducing activities that work for you—exercise, meditation, time with family, or creative pursuits.

Hour 6-24: Extract and Document

While the conversation is still fresh, document all feedback received. Include both explicit comments and implicit signals you observed during the meeting.

Hour 24-48: Analyze and Plan

Categorize the feedback using the framework above and create specific action items for each category. Prioritize changes that address multiple investor concerns simultaneously.

The Continuous Improvement Loop

Transform your fundraising process into a continuous improvement system:

Weekly Retrospectives: Every Friday, review the week's investor interactions. What worked well? What could be improved? What patterns are emerging?

Monthly Strategy Reviews: Assess whether your overall fundraising strategy is working. Are you targeting the right investors? Is your pitch resonating? Do you need to adjust your approach?

Quarterly Deep Dives: Conduct comprehensive reviews of your fundraising progress. This might involve updating your pitch deck, refining your investor targeting, or even considering strategic pivots based on accumulated feedback.

The Momentum Multiplication Effect

The most counterintuitive finding from fundraising psychology research is that founders who systematically implement these recovery protocols often perform better after rejection than before it. This "momentum multiplication effect" occurs because:

- Processed feedback makes pitches more compelling

- Improved resilience increases confidence and authenticity

- Systematic approaches reduce cognitive load and decision fatigue

- Recovery protocols prevent emotional accumulation that impairs performance

Building Your Fundraising Resilience System

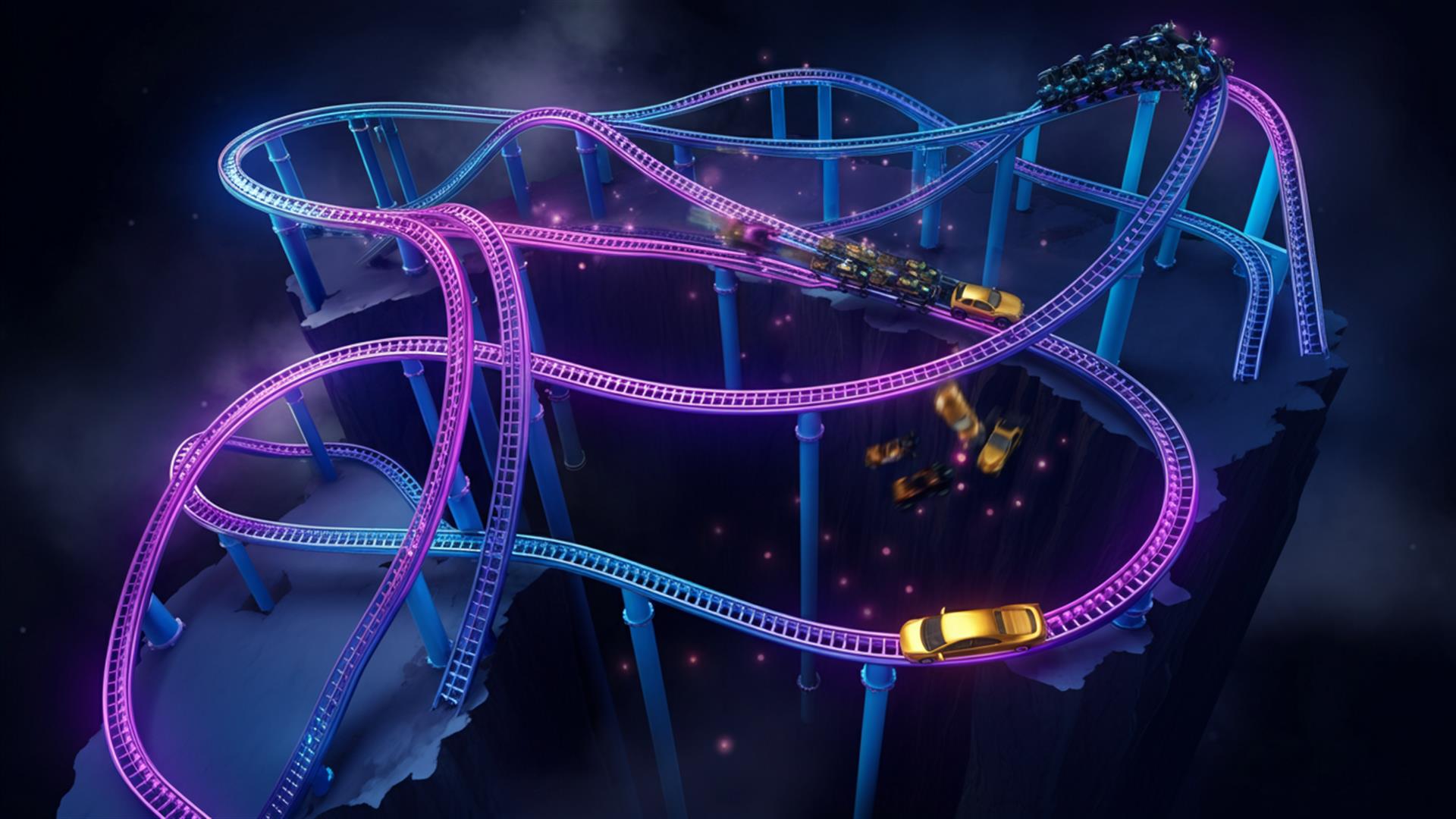

The difference between founders who successfully raise capital and those who quit isn't talent, market timing, or even product quality. It's the systematic application of psychological resilience frameworks that transform fundraising from an emotional rollercoaster into a strategic process.

Remember: every successful founder has faced rejection. What separates them is how they process, learn from, and use that rejection to improve their approach. The 68% who quit aren't less capable—they simply lack the psychological tools to maintain momentum through the inevitable challenges of fundraising.

Your fundraising journey doesn't have to be a battle against your own psychology. With the right frameworks, systems, and mindset, you can join the 32% who persist through challenges and ultimately achieve their funding goals.

Ready to build your fundraising resilience system? FounderScore's comprehensive platform provides the tools, insights, and support you need to maintain momentum throughout your fundraising journey. From pitch optimization to investor matching, we help founders like you navigate the psychological and tactical challenges of raising capital.

Ready to validate your business plan?

Get AI-powered analysis and match with investors who share your vision.

Get Started Free →